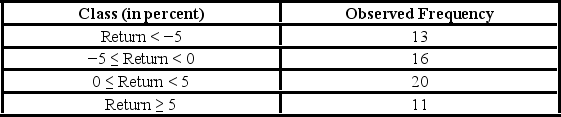

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over the time period, the following summary statistics are provided: Mean = 0.31%, Standard deviation = 6.49%, Skewness = 0.15, and Kurtosis = 0.38. At the 5% confidence level, which of the following is the correct conclusion for this goodness-of-fit test for normality?

Over the time period, the following summary statistics are provided: Mean = 0.31%, Standard deviation = 6.49%, Skewness = 0.15, and Kurtosis = 0.38. At the 5% confidence level, which of the following is the correct conclusion for this goodness-of-fit test for normality?

A) Reject the null hypothesis; conclude that monthly stock returns are normally distributed with mean 0.31% and standard deviation 6.49%.

B) Reject the null hypothesis; conclude that monthly stock returns are not normally distributed with mean 0.31% and standard deviation 6.49%.

C) Do not reject the null hypothesis; conclude that monthly stock returns are normally distributed with mean 0.31% and standard deviation 6.49%

D) Do not reject the null hypothesis; conclude that monthly stock returns are not normally distributed with mean 0.31% and standard deviation 6.49%.

Correct Answer:

Verified

Q102: The following frequency distribution shows the monthly

Q103: The following table shows numerical summaries of

Q104: Suppose Bank of America would like to

Q105: The following table shows the cross-classification of

Q106: The following frequency distribution shows the monthly

Q108: A researcher wants to determine if the

Q109: The following frequency distribution shows the monthly

Q110: Suppose Bank of America would like to

Q111: The following frequency distribution shows the monthly

Q112: The following table shows the observed frequencies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents