An investment analyst wants to examine the relationship between a mutual fund's return, its turnover rate, and its expense ratio. She randomly selects 10 mutual funds and estimates:

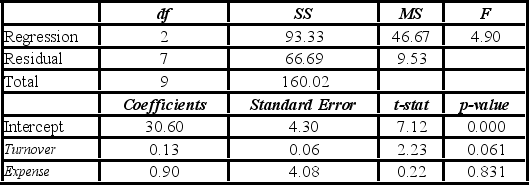

Return = β0 + β1Turnover + β2Expense + ε, where Return is the average five-year return  , Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.

, Turnover is the annual holdings turnover (in %), Expense is the annual expense ratio (in %), and ε is the random error component. A portion of the regression results is shown in the accompanying table.  a. Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a. Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

B) Interpret the slope coefficient for the variable Expense.

C) Calculate the standard error of the estimate.

D) Calculate and interpret the coefficient of determination.

Correct Answer:

Verified

b. If the expense ratio goes u...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q130: John is an undergraduate business major studying

Q131: A statistics instructor wants to examine the

Q132: An admissions officer wants to examine the

Q133: Data was collected for 30 professional tennis

Q134: The following portion of regression results was

Q135: Consider the following information regarding a response

Q136: When estimating a multiple regression model, the

Q137: A portfolio manager is interested in reducing

Q138: A manager at a ski resort in

Q139: The following ANOVA table was obtained when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents