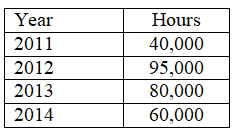

On January 1, 2011, the Peninsula Paper Company purchased manufacturing equipment for $600,000. The equipment has a 4-year estimated useful life and a salvage value of $22,500. The company expects to use the equipment for 275,000 hours. Actual hours the equipment was used are provided in the table below:

Required: Calculate the depreciation expense for each year of the asset's life using:

1. the straight-line method,

2. the double-declining balance method, and

3. the activity (units-of-production) method

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: An accelerated depreciation method refers to any

Q75: The amount recorded as the cost of

Q76: Which assets are amortized?

A)intangible assets

B)natural resources

C)property,plant and

Q77: Which assets are depreciated?

A)intangible assets

B)natural resources

C)property,plant and

Q78: Which of the following is NOT an

Q79: On January 1, 2011, the Peninsula Paper

Q81: Use the following code to identify the

Q82: Which of the following should be recorded

Q83: A business will have depletion expense only

Q84: Under U.S.GAAP,research and development costs (R&D)are not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents