Tennyson LTP purchased computers on January 1,2011,at a cost of $120,000.The estimated useful life of the computers is 4 years and there is no estimated salvage value.

Required:

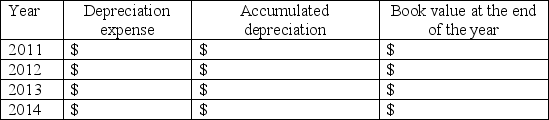

1.Complete the depreciation schedule below assuming Tennyson uses the straight-line method.

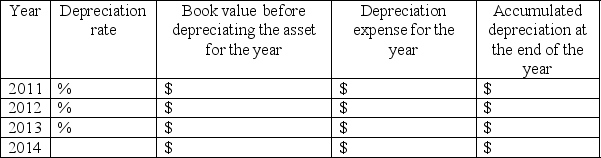

2.Complete the depreciation schedule below assuming Tenison uses the double-declining balance method.

2.Complete the depreciation schedule below assuming Tenison uses the double-declining balance method.

3.Which method would report the greater net income to the shareholders for 2011?

3.Which method would report the greater net income to the shareholders for 2011?

4.Which method results in the higher amount of total depreciation expense over the four-year life of the asset?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: According to GAAP,which of the following items

Q149: A factory machine was purchased on January

Q150: Which depreciation method will result in the

Q151: On January 1,2011,Handy Manufacturing Company paid $50,000

Q152: Under International Financial Reporting Standards (IFRS),when assets

Q154: Which financial statement reports long-term assets?

A)the balance

Q155: International Financial Reporting Standards (IFRS)allow revaluation of

Q156: S.GAAP value plant and equipment at historical

Q157: On January 1,2011,Tiler Company purchased equipment that

Q158: On January 1,2011,Albatross Shipping Company bought equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents