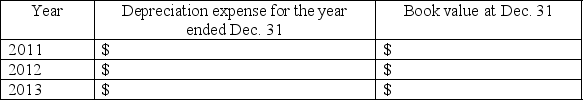

On January 1,2011,Tiler Company purchased equipment that cost $30,000.The equipment has an estimated useful life of 6 years and an estimated salvage value of $3,000.

Required:

1.Using the straight-line method,complete the chart below:

2.Explain why long-term assets must be depreciated.

2.Explain why long-term assets must be depreciated.

3.Explain why land is NOT depreciated while assets such as equipment are depreciated.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q152: Under International Financial Reporting Standards (IFRS),when assets

Q153: Tennyson LTP purchased computers on January 1,2011,at

Q154: Which financial statement reports long-term assets?

A)the balance

Q155: International Financial Reporting Standards (IFRS)allow revaluation of

Q156: S.GAAP value plant and equipment at historical

Q158: On January 1,2011,Albatross Shipping Company bought equipment

Q159: What effect does depreciating a long-term asset

Q160: What basic information must be disclosed about

Q161: Use the following selected information from ABC

Q162: A client has asked you to review

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents