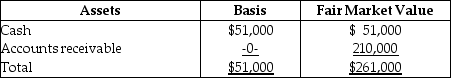

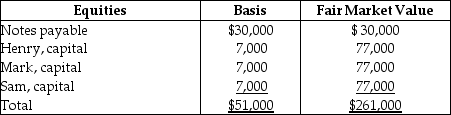

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities)at the time of the sale was $17,000.In addition, Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities)at the time of the sale was $17,000.In addition, Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: What is included in the definition of

Q64: Joshua is a 40% partner in the

Q74: Eicho's interest in the DPQ Partnership is

Q80: Can a partner recognize both a gain

Q85: Sean, Penelope, and Juan formed the SPJ

Q94: Tony sells his one-fourth interest in the

Q103: What are the advantages of a firm

Q104: All states have adopted laws providing for

Q106: The limited liability company (LLC)has become a

Q107: What is an electing large partnership? What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents