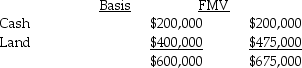

Sean, Penelope, and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000.In the following year, Penelope sold her one-third interest to Pedro for $225,000.At the time of the sale, the SPJ partnership had the following balance sheet:

Shortly after Pedro became a partner, SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place, and (2)assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner, SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place, and (2)assuming the partnership has a valid Section 754 election?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Jerry has a $50,000 basis for his

Q41: What is included in the definition of

Q50: Do most distributions made by a partnership

Q64: Joshua is a 40% partner in the

Q68: What is the character of the gain/loss

Q74: Eicho's interest in the DPQ Partnership is

Q83: On December 31, Kate receives a $28,000

Q84: Tony sells his one-fourth interest in the

Q90: The HMS Partnership, a cash method of

Q107: What is an electing large partnership? What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents