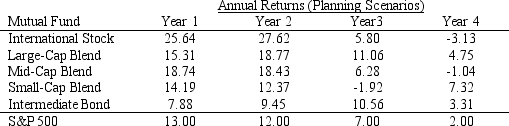

Lymann Brothers has a substantial number of clients who wish to own a mutual fund portfolio that closely matches the performance of the S&P 500 stock index.A manager at Lymann Brothers has selected five mutual funds that will be considered for inclusion in the portfolio.The manager must decide what percentage of the portfolio should be invested in each mutual fund.

Minimize the variance of the portfolio subject to constraints on the expected return,assuming that Lymann Brothers' client requires the expected portfolio return to be at least 9 percent.

Minimize the variance of the portfolio subject to constraints on the expected return,assuming that Lymann Brothers' client requires the expected portfolio return to be at least 9 percent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: For a typical nonlinear problem, duals price

Q2: The interpretation of the dual price for

Q11: For a minimization problem,a point is a

Q15: An index fund is an example of

Q32: Native Customs sells two popular styles of

Q33: Hervis Car Rental in Austin,TX has 50

Q35: Portfolio manager Max Gaines needs to develop

Q36: MegaSports,Inc.produces two high-priced metal baseball bats,the Slugger

Q41: LeapFrog Airways provides passenger service for Indianapolis,Baltimore,Memphis,Austin,and

Q42: Skooter's Skateboards produces two models of skateboards,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents