Pan Corporation,a U.S.company,formed a British subsidiary on January 1,2014 by investing 450,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary,Skillet Corporation,purchased real property on April 1,2014 at a cost of £500,000,with £100,000 allocated to land and £400,000 allocated to a building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The British pound is Skillet's functional currency and its reporting currency.The British economy does not have high rates of inflation.Exchange rates for the pound on various dates were:

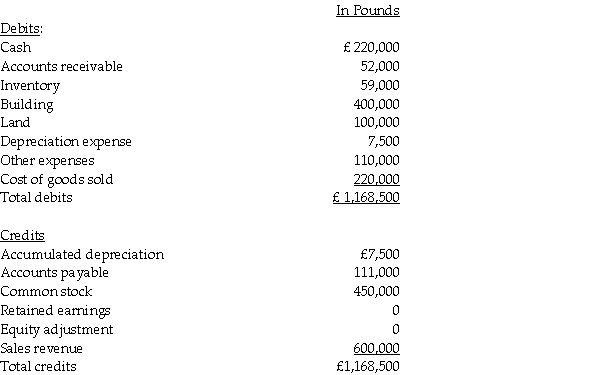

Skillet's adjusted trial balance is presented below for the year ended December 31,2014.

Required:

Prepare Skillet's:

1.Translation working papers;

2.Translated income statement;and

3.Translated balance sheet.

Correct Answer:

Verified

Q29: Par Industries,a U.S.Corporation,purchased Slice Company of New

Q30: Plate Corporation,a US company,acquired ownership of Saucer

Q31: On January 1,2014,Psalm Corporation purchased all the

Q32: Plane Corporation,a U.S.company,owns 100% of Shipp Corporation,a

Q33: Note to Instructor: This exam item is

Q34: Phim Inc. ,a U.S.company,owns 100% of Sera

Q35: Each of the following accounts has been

Q36: Note to Instructor: This exam item is

Q38: On January 1,2014,Planet Corporation,a U.S.company,acquired 100% of

Q39: Plato Corporation,a U.S.company,purchases all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents