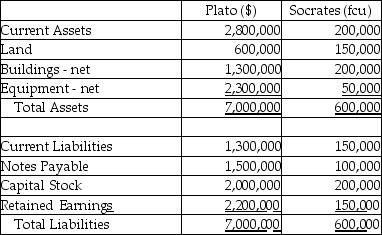

Plato Corporation,a U.S.company,purchases all of the outstanding stock of Socrates Company,which operates outside the U.S.on January 1,2014.Socrates' net assets have fair values that equal their book values with the exception of land that has a fair value of 200,000 foreign currency units and equipment with a fair value of 100,000 foreign currency units.Plato paid $180,000 for this acquisition.The balance sheets for Plato and Socrates are shown below just before the business combination.Socrates' functional currency is the foreign currency unit (fcu)and the exchange rate at the date of acquisition was $.40 per fcu.Socrates uses the fcu for record-keeping purposes.

Required:

Prepare a consolidated balance sheet for Plato and subsidiary at January 1,2014 immediately following the business combination.

Correct Answer:

Verified

Q29: Par Industries,a U.S.Corporation,purchased Slice Company of New

Q30: Plate Corporation,a US company,acquired ownership of Saucer

Q31: On January 1,2014,Psalm Corporation purchased all the

Q32: Plane Corporation,a U.S.company,owns 100% of Shipp Corporation,a

Q33: Note to Instructor: This exam item is

Q34: Phim Inc. ,a U.S.company,owns 100% of Sera

Q35: Each of the following accounts has been

Q36: Note to Instructor: This exam item is

Q37: Pan Corporation,a U.S.company,formed a British subsidiary on

Q38: On January 1,2014,Planet Corporation,a U.S.company,acquired 100% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents