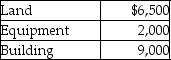

Hastings Corporation has purchased a group of assets for $15,000.The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?

A) $1,962

B) $5,571

C) $1,714

D) $7,714

Correct Answer:

Verified

Q4: Fred Inc.owns a delivery truck.Which of the

Q8: Capitalizing the cost of an asset involves

Q9: The process of allocating the cost of

Q10: The lump-sum amount paid for a group

Q15: Land and land improvements are one and

Q16: The cost principle requires a business to

Q17: Repair work that generates a capital expenditure

Q19: Plant assets are long-lived,tangible assets used in

Q19: Which of the following is a characteristic

Q29: A lump-sum purchase or basket purchase involves

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents