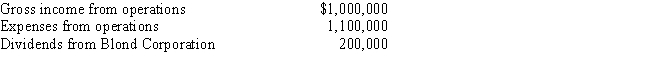

In the current year, Auburn Corporation (a calendar year taxpayer) , has the following income and expenses:

Auburn Corporation owns 20% of the stock in Blond Corporation. The dividends received deduction for the current year is:

Auburn Corporation owns 20% of the stock in Blond Corporation. The dividends received deduction for the current year is:

A) $200,000.

B) $160,000.

C) $100,000.

D) $80,000.

E) None of the above.

Correct Answer:

Verified

Q95: In completing Schedule M-1 (reconciliation of income

Q96: Aiden and Addison form Dove Corporation with

Q97: In comparing C corporations with individuals, which

Q98: To improve its liquidity, the shareholders of

Q99: Which, if any, of the following costs

Q101: Jerry is the sole shareholder of Bluejay

Q102: Laurie is a 70% shareholder in Martin

Q103: During the current year, Scarlet had taxable

Q104: Camilla and Dean form Grouse Corporation with

Q105: Elijah contributes land (basis of $80,000; fair

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents