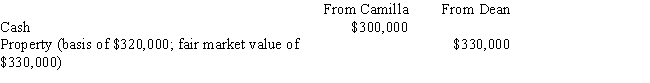

Camilla and Dean form Grouse Corporation with the following investment:  Camilla and Dean each receive 300 shares of stock in Grouse Corporation and, in addition, Dean receives $30,000 in cash. As a result of the transfer, Dean's basis in the stock and Grouse's basis in the property will be:

Camilla and Dean each receive 300 shares of stock in Grouse Corporation and, in addition, Dean receives $30,000 in cash. As a result of the transfer, Dean's basis in the stock and Grouse's basis in the property will be:

A) $330,000 and $300,000.

B) $300,000 and $330,000.

C) $310,000 and $300,000.

D) $290,000 and $310,000.

E) None of the above.

Correct Answer:

Verified

Q99: Which, if any, of the following costs

Q100: In the current year, Auburn Corporation (a

Q101: Jerry is the sole shareholder of Bluejay

Q102: Laurie is a 70% shareholder in Martin

Q103: During the current year, Scarlet had taxable

Q105: Elijah contributes land (basis of $80,000; fair

Q106: Silver Corporation has held an S election

Q107: In December 2017, Swallow Company's board authorizes

Q108: Mel, Fred, and Mary form Canary Corporation.

Q109: Which of the following statements, if any,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents