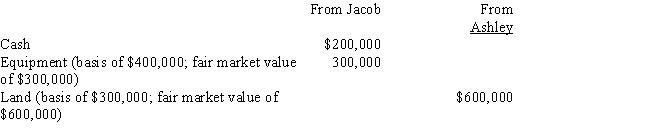

Jacob and Ashley form Junco Corporation with the following investments:  Jacob and Ashley each receive one-half of the Junco stock. In addition, Ashley receives cash of $100,000. One of the results of these transfers is:

Jacob and Ashley each receive one-half of the Junco stock. In addition, Ashley receives cash of $100,000. One of the results of these transfers is:

A) Jacob has a recognized loss of $100,000.

B) Ashley has a recognized gain of $300,000.

C) Junco Corporation has a basis in the land of $400,000.

D) Ashley's basis in the Junco Corporation stock is $500,000.

E) None of the above.

Correct Answer:

Verified

Q109: Which of the following statements, if any,

Q110: As of January 1, 2017, Amanda, the

Q111: On January 1, 2017, Copper Corporation (a

Q112: During the current year, Brown had taxable

Q113: In determining the taxable income (or loss)

Q115: As of January 1, 2017, Donald, the

Q116: Which, if any, of the following transactions

Q117: Snipe Corporation, a calendar year taxpayer, has

Q118: Jean is a shareholder in Parrot Corporation,

Q119: Jim, Betty, and Bill form Crow Corporation.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents