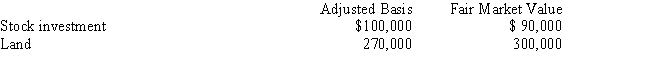

Snipe Corporation, a calendar year taxpayer, has total E & P of $800,000. During the current year, Snipe makes property distributions to Tracy (the sole shareholder) as follows:  As a result of these distributions:

As a result of these distributions:

A) Snipe Corporation must recognize a gain of $30,000 and no recognized loss.

B) Snipe Corporation must recognize a gain of $30,000 and recognize a loss of $10,000.

C) Snipe Corporation recognizes neither gain nor loss.

D) Tracy will have a basis of $100,000 in the stock investment and $270,000 in the land.

E) None of the above.

Correct Answer:

Verified

Q112: During the current year, Brown had taxable

Q113: In determining the taxable income (or loss)

Q114: Jacob and Ashley form Junco Corporation with

Q115: As of January 1, 2017, Donald, the

Q116: Which, if any, of the following transactions

Q118: Jean is a shareholder in Parrot Corporation,

Q119: Jim, Betty, and Bill form Crow Corporation.

Q120: In determining a partner's basis in the

Q121: Auburn Corporation owns 6% of the stock

Q122: In the current year, Rose Corporation, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents