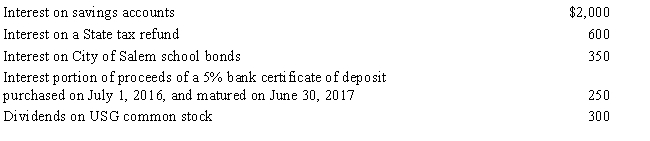

George, an unmarried cash basis taxpayer, received the following amounts during 2017:  What amount should George report as gross income from dividends and interest for 2017?

What amount should George report as gross income from dividends and interest for 2017?

A) $2,300.

B) $2,550.

C) $3,150.

D) $3,500.

E) None of these.

Correct Answer:

Verified

Q89: In the case of interest income from

Q93: Heather's interest and gains on investments for

Q94: Sandy is married, files a joint return,

Q96: Barbara was injured in an automobile accident.

Q97: George is employed by the Quality Appliance

Q99: On January 1, 2007, Cardinal Corporation issued

Q100: Tonya is a cash basis taxpayer. In

Q101: Sonja is a United States citizen who

Q105: Employers can provide numerous benefits to their

Q112: What Federal income tax benefits are provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents