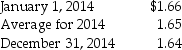

On January 1,2014,Psalm Corporation purchased all the stock of Solomon Corporation for $481,400 when Solomon had capital stock of 180,000 pounds (£)and retained earnings of 90,000£.The book value of Solomon's assets and liabilities represented the fair value,except for equipment with a 5-year life that was undervalued by 15,000£.Any remaining excess is due to a patent with a useful life of 6 years.Solomon's functional currency is the pound.Solomon's books are kept in pounds.Relevant exchange rates for a pound follow:

Required:

Required:

1.Determine the equity adjustment on translation of the excess differential assigned to equipment at December 31,2014.

2.Determine the equity adjustment on translation of the excess differential assigned to patent at December 31,2014.

Correct Answer:

Verified

Equity adjustment from e...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: On January 1,2014,Pilgrim Corporation,a U.S.firm,acquired ownership of

Q36: The Polka Corporation,a U.S.corporation,formed a British

Q37: Plato Corporation,a U.S.company,purchases all of the outstanding

Q38: Each of the following accounts has been

Q39: Puddle Incorporated purchased an 80% interest in

Q41: When all elements of the financial statements

Q42: For foreign subsidiaries whose functional currency is

Q43: Gains and losses from foreign currency transactions

Q44: Intercompany transactions that produce receivable balances denominated

Q45: When the functional currency of a foreign

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents