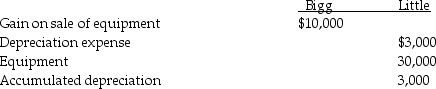

On January 1,2014,Bigg Corporation sold equipment with a book value of $20,000 and a 10-year remaining useful life to its wholly-owned subsidiary,Little Corporation,for $30,000.Both Bigg and Little use the straight-line depreciation method,assuming no salvage value.On December 31,2014,the separate company financial statements held the following balances associated with the equipment:  A working paper entry to consolidate the financial statements of Bigg and Little on December 31,2014 included a

A working paper entry to consolidate the financial statements of Bigg and Little on December 31,2014 included a

A) debit to equipment for $10,000.

B) credit to gain on sale of equipment for $10,000.

C) debit to accumulated depreciation for $1,000.

D) credit to depreciation expense for $3,000.

Correct Answer:

Verified

Q1: On January 2,2014,Paogo Company sold a truck

Q2: Use the following information to answer the

Q3: Use the following information to answer the

Q4: Use the following information to answer the

Q5: Use the following information to answer the

Q7: Plenny Corporation sold equipment to its 90%-owned

Q8: Use the following information to answer the

Q9: Use the following information to answer the

Q10: Petrol Company acquired a 90% interest in

Q11: Parrot Company owns all the outstanding voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents