Use the following information to answer the question(s) below.

On December 31, 2014, Pinne Corporation sold equipment with a three-year remaining useful life and a book value of $21,000 to its 70%-owned subsidiary, Sull Company, for a price of $27,000. Pinne bought the equipment four years ago for $49,000. The salvage value is zero. Straight-line depreciation is used by both companies.

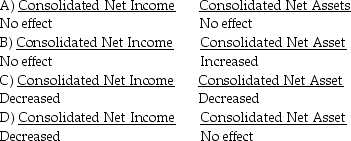

-After eliminating/adjusting entries are prepared,what was the intercompany sale impact on the consolidated financial statements for the year ended December 31,2014?

Correct Answer:

Verified

Q4: Use the following information to answer the

Q5: Use the following information to answer the

Q6: On January 1,2014,Bigg Corporation sold equipment with

Q7: Plenny Corporation sold equipment to its 90%-owned

Q8: Use the following information to answer the

Q10: Petrol Company acquired a 90% interest in

Q11: Parrot Company owns all the outstanding voting

Q12: Assume an upstream sale of machinery occurs

Q13: On January 1,2014 Saffron Co.recorded a $40,000

Q14: Parrot Corporation acquired a 70% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents