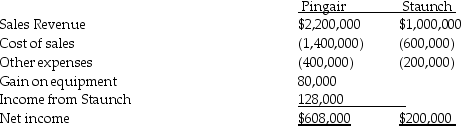

Separate income statements of Pingair Corporation and its 90%-owned subsidiary,Staunch Inc.,for 2014 were as follows:

Additional information:

Additional information:

1.Pingair acquired its 90% interest in Staunch Inc.when the book values were equal to the fair values.

2.The gain on equipment relates to equipment with a book value of $120,000 and a 4-year remaining useful life that Pingair sold to Staunch for $200,000 on January 2,2014.The straight-line depreciation method is used.The equipment has no salvage value.

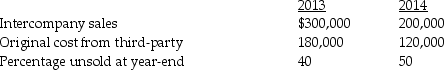

3.Pingair sold inventory to Staunch in 2013 and 2014 as shown in the table below.(The 2013 ending inventory is sold in 2014.)

4.Staunch did not declare or pay dividends in 2013 and 2014.

4.Staunch did not declare or pay dividends in 2013 and 2014.

Required:

1.Prepare adjusting/eliminating entries for the consolidation worksheet at December 31,2014.

2.Prepare a consolidated income statement for Pingair Corporation and Subsidiary for the year ended December 31,2014.

Correct Answer:

Verified

12/31/2014

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Several years ago,Peacock International purchased 80% of

Q36: Plock Corporation,the 75% owner of Seraphim Company,reported

Q37: Pollek Corporation paid $16,200 for a 90%

Q38: Passo Corporation acquired a 70% interest in

Q39: Several years ago,Pilot International purchased 70% of

Q41: The transfer of nondepreciable plant assets between

Q42: An entry is necessary to eliminate the

Q43: Unrealized profits or losses on plant assets

Q44: Gross profit on inventory items sold for

Q45: The parent affiliate recognizes a gain on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents