Passo Corporation acquired a 70% interest in Saun Corporation in 2009 at a time when Saun's book values and fair values were equal.In 2012,Saun sold land to Passo for $82,000 that cost $72,000.The land remained in Passo's possession until 2014 when Passo sold it outside the combined entity for $102,000.

After the books were closed in 2014,it was discovered that Passo had not considered the unrealized gain from its intercompany purchase of land in preparing the consolidated financial statements.The only entry on Passo's books was a debit to Land and a credit to Cash in 2012 for $82,000,and in 2014,a debit to Cash for $102,000 and credits to Land for $82,000 and Gain on sale of land for $20,000.

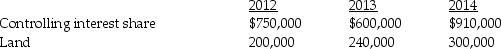

Before the discovery of the error,the consolidated financial statements disclosed the following amounts:

Required:

Required:

1.Prepare elimination/adjusting entries relating to the land on the consolidated working papers for December 31,2012,December 31,2013 and December 31,2014.

2.Determine the correct amounts for Land in 2012,2013,and 2014.

3.Calculate the amount at which the gain on the sale of land should have been reported in 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: On January 1,2013,Pilgrim Imaging purchased 90% of

Q34: Park Incorporated purchased a 70% interest in

Q35: Several years ago,Peacock International purchased 80% of

Q36: Plock Corporation,the 75% owner of Seraphim Company,reported

Q37: Pollek Corporation paid $16,200 for a 90%

Q39: Several years ago,Pilot International purchased 70% of

Q40: Separate income statements of Pingair Corporation and

Q41: The transfer of nondepreciable plant assets between

Q42: An entry is necessary to eliminate the

Q43: Unrealized profits or losses on plant assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents