On January 1,2013,Pilgrim Imaging purchased 90% of the outstanding common stock of Snapshot Productions for $585,000 cash.The remaining 10% of Snapshot had an assessed fair value of $65,000 at that time.Snapshot had equipment that was undervalued on their books by $50,000,and an unrecorded patent with a fair value of $15,000.The equipment had five years remaining to its useful life,and the patent had 10 years remaining to its useful life.

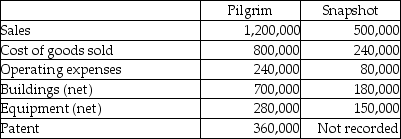

On January 1,2014,Pilgrim sold Snapshot a building for $100,000 that had originally cost $140,000.The book value was $60,000 at the date of transfer,and had a five-year remaining life at the date of transfer.Straight-line depreciation is used with no salvage value.Several line items from the companies' separate December 31,2014 trial balances are shown below.

Required: Determine consolidated balances for each of the accounts listed as of December 31,2014.

Required: Determine consolidated balances for each of the accounts listed as of December 31,2014.

Correct Answer:

Verified

Q28: On January 2,2014,Pal Corporation sold warehouse equipment

Q29: An intercompany gain or loss appears in

Q30: Separate income statements of Plantation Corporation and

Q31: Plower Corporation acquired all of the outstanding

Q32: Snow Company is a wholly owned subsidiary

Q34: Park Incorporated purchased a 70% interest in

Q35: Several years ago,Peacock International purchased 80% of

Q36: Plock Corporation,the 75% owner of Seraphim Company,reported

Q37: Pollek Corporation paid $16,200 for a 90%

Q38: Passo Corporation acquired a 70% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents