Multiple Choice

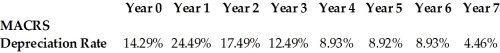

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

A) $974,680

B) $1,218,350

C) $2,193,030

D) $6,091,750

Correct Answer:

Verified

Related Questions