MACRS

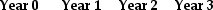

MACRS A firm is considering the purchase of a new machine for $325,000. The firm is unsure if it should use the 3-Year MACRS schedule or straight-line depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straight-line depreciation?

A firm is considering the purchase of a new machine for $325,000. The firm is unsure if it should use the 3-Year MACRS schedule or straight-line depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straight-line depreciation?

A) $0

B) $24,083

C) $48,166

D) $300,918

Correct Answer:

Verified

Q28: How are the taxes paid under MACRS

Q71: What is the most important function of

Q72: Q73: An insurance office owns a large building Q74: A firm is considering a new project Q75: Q77: The term "cannibalization" refers to _. Q78: The Sisyphean Corporation is considering investing in Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

A) decrease