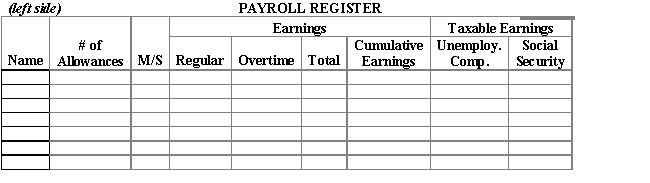

F.Fuentes operates a business known as Variety Unlimited.Listed below are the name,number of allowances claimed,marital status,total hours worked,and hourly rate of each employee.All hours worked in excess of 40 hours per week are paid at the rate of time and a half.

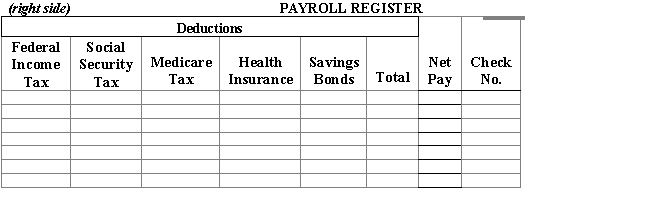

The employer uses the weekly federal income tax withholding table.Social Security tax is withheld at the rate of 6.2%,Medicare tax is withheld at the rate of 1.45%.All employees have Health Insurance Premiums withheld in the amount of $55.00.Hertz,Jordan,and Pollo each will have $25.00 withheld this payday under a savings bond purchase plan.

Fuentes follows the practice of drawing a single check for the net amount of the payroll and depositing the check in a special payroll account at the bank.Individual paychecks are then drawn for the amount due each employee.The checks issued this payday were numbered consecutively beginning with No.786.

Required:

1.Prepare a payroll register for Variety Unlimited for the pay period ended December 15,20--.

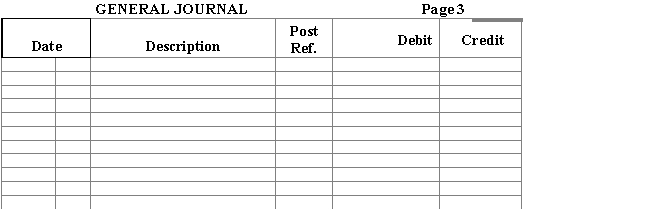

2.Assuming that the wages for the week ended December 15 were paid on December 17,enter the payment in the general journal.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Gross pay less mandatory and voluntary deductions

Q71: The account that is debited for the

Q72: When a single-check for payroll is prepared

Q73: _ are compensation for skilled or unskilled

Q74: The payroll register for the week ended

Q76: Ian McCarthy works for Willow Tree

Q77: Journalize the entry for Hot Rod

Q78: Jerri's Mason Supply Company has four

Q79: A(n)_ is a computerized system based on

Q80: The account that is credited for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents