Jerri's Mason Supply Company has four employees who are paid on a weekly basis receiving time and a half for working more than 40 hours in any one week.The payroll data for the week ended December 10 is as follows:

?

Social Security tax is withheld at 6.2% and Medicare tax at 1.45%.Each employee that is single has $40 withheld for health insurance and each that is married has $70 withheld.Higgins has $25 withheld for United Way.Number the checks beginning with 803.

Required:

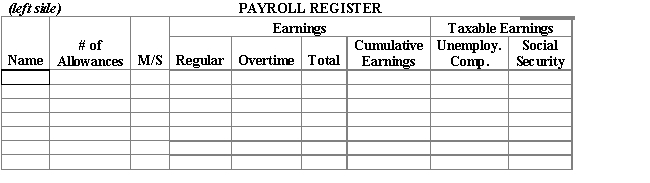

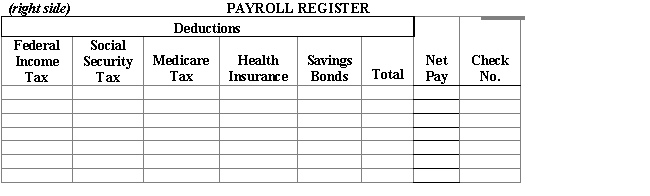

1.Complete the payroll register.

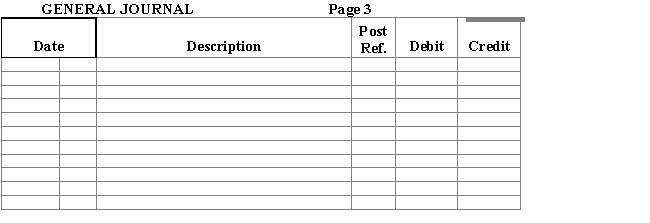

2.Journalize the payroll entry.

?

?

?

?

?

?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q73: _ are compensation for skilled or unskilled

Q74: The payroll register for the week ended

Q75: F.Fuentes operates a business known as

Q76: Ian McCarthy works for Willow Tree

Q77: Journalize the entry for Hot Rod

Q79: A(n)_ is a computerized system based on

Q80: The account that is credited for the

Q81: Match the terms with the definitions.

- Exempts

Q82: The account,_,should be credited for the total

Q83: Match the terms with the definitions.

-An employee's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents