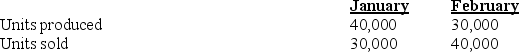

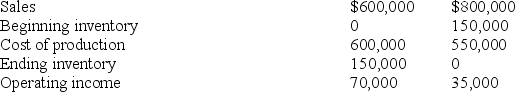

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up. Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5, and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences. How would variable costing income statements help the manager understand the division's operating income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Critics of absorption costing suggest to evaluate

Q90: Which method is NOT a way to

Q91: Moore Company prepared the following absorption-costing income

Q91: Under absorption costing,if a manager's bonus is

Q92: Companies have recently been able to reduce

Q92: Explain the difference between the gross margin

Q93: Differences between absorption costing and variable costing

Q95: Galliart Company has two identical divisions, East

Q97: The following data are available for Ruggles

Q98: Ways to "produce for inventory" that result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents