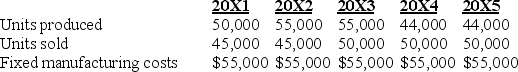

Galliart Company has two identical divisions, East and West. Their sales, production volume, and fixed manufacturing costs have been the same for the last five years. The amounts for each division were as follows:

East Division uses absorption costing and West Division uses variable costing.

East Division uses absorption costing and West Division uses variable costing.

Both use FIFO inventory methods.

Variable manufacturing costs are $5 per unit.

Selling and administrative expenses were identical for each division.

There were no inventories at the beginning of 20X1.

Which division reports the highest income each year? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Switching production to products that absorb the

Q90: Which method is NOT a way to

Q91: Moore Company prepared the following absorption-costing income

Q91: Under absorption costing,if a manager's bonus is

Q92: Companies have recently been able to reduce

Q92: Explain the difference between the gross margin

Q93: Differences between absorption costing and variable costing

Q94: The manager of the manufacturing division of

Q97: The following data are available for Ruggles

Q98: Ways to "produce for inventory" that result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents