On November 1, 2013, Stateside Company (a U.S. manufacturer) sold an airplane for 1 million New Zealand dollars (NZ$) to New Zealand company Aukland Corporation. Stateside will receive payment on January 30, 2014 in New Zealand dollars. In order to hedge the accounts receivable position, Stateside entered into a 90-day forward contract to sell 1 million New Zealand dollars on January 30, 2014. On November 1, 2013, the 90-day forward rate is US$0.73 per New Zealand dollar. The forward contract will be settled net. Account for the hedge as a fair value hedge. Ignore the time value of money.

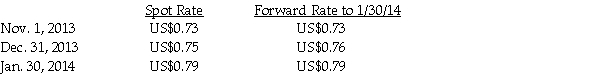

The relevant exchange rates per New Zealand dollar:

Required:

Required:

Record the journal entries that Stateside would need to prepare at November 1, 2013, December 31, 2013 and January 30, 2014. December 31, 2013 is the fiscal year end.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: When a cash flow hedge is appropriate,the

Q22: Onoly Corporation (a U.S. manufacturer) sold parts

Q23: On March 1, 2014, Amber Company sold

Q26: Wild West, Incorporated (a U.S. corporation) sold

Q29: On November 1, 2013, Ironside Company (a

Q30: Slickton Corporation, a U.S. holding company, enters

Q31: On November 1,2013,Athom Corporation purchased 5,000 television

Q32: On January 1,2014,Bambi borrowed $500,000 from Lonni.The

Q34: Opie Industries is a manufacturer of plastic

Q37: On November 1,2013,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents