On November 1, 2013, Ironside Company (a U.S. manufacturer) sold an airplane for 1 million New Zealand dollars (NZ$) to a New Zealand company, Wellington Corporation. Ironside will receive payment on January 30, 2014 in New Zealand dollars. In order to hedge the accounts receivable position, Ironside entered into a 90-day forward contract on November 1, 2013 to sell 1 million New Zealand dollars. On November 1, 2013, the forward rate is US$0.79 per New Zealand dollar. The forward contract will be settled net. This is a fair value hedge. Ignore the time value of money.

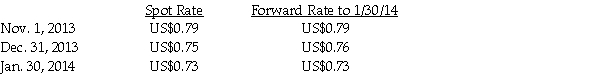

The relevant exchange rates per New Zealand dollar:

Required:

Required:

Record the journal entries that Stateside would need to prepare at November 1, 2013, December 31, 2013 and January 30, 2014. December 31 is the fiscal year end.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: On November 1, 2013, Stateside Company (a

Q26: Wild West, Incorporated (a U.S. corporation) sold

Q30: Slickton Corporation, a U.S. holding company, enters

Q31: On November 1,2013,Athom Corporation purchased 5,000 television

Q31: Ferb Company is a U.S.-based importer of

Q33: On November 1, 2014, Ross Corporation, a

Q34: Opie Industries is a manufacturer of plastic

Q34: On November 1, 2014, Portsmith Corporation, a

Q37: On November 1,2013,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Q40: On December 18,2014,Wabbit Corporation (a U.S.Corporation)has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents