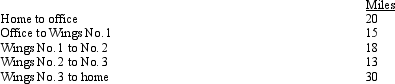

Aiden is the city sales manager for "Wings," a national fast food franchise.Every working day, Aiden drives his car as follows:  Aiden's deductible mileage is:

Aiden's deductible mileage is:

A) 0 miles.

B) 30 miles.

C) 46 miles.

D) 76 miles.

E) None of the above.

Correct Answer:

Verified

Q35: A participant who is at least age

Q37: Distributions from a Roth IRA that are

Q62: In a direct transfer from one qualified

Q69: For self-employed taxpayers, travel expenses are not

Q79: Ryan performs services for Jordan. Which, if

Q82: The § 222 deduction for tuition and

Q86: Aaron is a self-employed practical nurse who

Q92: Under the actual cost method, which, if

Q93: When using the automatic mileage method, which,

Q100: A worker may prefer to be treated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents