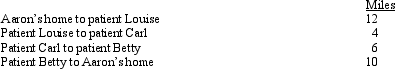

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

A) 10 miles.

B) 12 miles.

C) 20 miles.

D) 22 miles.

E) 32 miles.

Correct Answer:

Verified

Q81: Aiden is the city sales manager for

Q82: The § 222 deduction for tuition and

Q87: Carolyn is single and has a college

Q88: Due to a merger, Allison transfers from

Q90: During the year, Oscar travels from Raleigh

Q91: A worker may prefer to be classified

Q92: Under the actual cost method, which, if

Q93: When using the automatic mileage method, which,

Q94: Allowing for the cutback adjustment (50% reduction

Q100: A worker may prefer to be treated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents