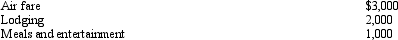

During the year, Oscar travels from Raleigh to Moscow (Russia) on business.His time was spent as follows: 2 days travel (one day each way) , 2 days business, and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement, Oscar's deductible expenses are:

Presuming no reimbursement, Oscar's deductible expenses are:

A) $6,000.

B) $5,500.

C) $4,500.

D) $3,500.

E) None of the above.

Correct Answer:

Verified

Q82: The § 222 deduction for tuition and

Q86: Aaron is a self-employed practical nurse who

Q86: Which, if any, of the following factors

Q87: Carolyn is single and has a college

Q88: Due to a merger, Allison transfers from

Q89: As to meeting the time test for

Q91: A worker may prefer to be classified

Q94: Allowing for the cutback adjustment (50% reduction

Q95: Amy works as an auditor for a

Q96: Dave is the regional manager for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents