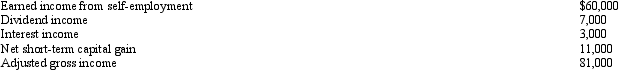

Debby is a self-employed accountant with a qualified defined benefit plan (a Keogh plan) .She has the following income items for the year: What is the maximum amount Debby can deduct as a contribution to her retirement plan in 2012, assuming the self-employment tax rate is 15.3%?

What is the maximum amount Debby can deduct as a contribution to her retirement plan in 2012, assuming the self-employment tax rate is 15.3%?

A) $9,235.

B) $12,000.

C) $50,000.

D) $55,761.

E) None of the above.

Correct Answer:

Verified

Q81: In which, if any, of the following

Q85: In terms of meeting the distance test

Q98: Statutory employees:

A) Report their expenses on Schedule

Q99: During the year, Peggy went from Nashville

Q100: During the year, Walt went from Louisville

Q102: Match the statements that relate to each

Q104: Kay, a single individual, participates in her

Q105: Joyce, age 39, and Sam, age 40,

Q116: Which, if any, of the following expenses

Q119: Which, if any, of the following is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents