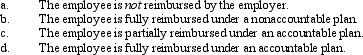

Discuss the 2%-of-AGI floor and the 50% cutback limitation in connection with various employee expenses under the following arrangements:

Correct Answer:

Verified

Q113: How are combined business/pleasure trips treated for

Q121: Ashley and Matthew are husband and wife

Q134: Concerning the deduction for moving expenses, what

Q156: In connection with the office in the

Q157: In terms of IRS attitude, what do

Q160: A taxpayer just changed jobs and incurred

Q161: Ramon and Ingrid work in the field

Q162: Regarding tax favored retirement plans for employees

Q163: Tom owns and operates a lawn maintenance

Q165: Felicia, a recent college graduate, is employed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents