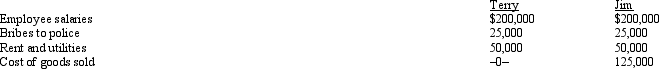

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Correct Answer:

Verified

Q61: Which of the following is incorrect?

A) Alimony

Q64: Which of the following cannot be deducted

Q74: Andrew, who operates a laundry business, incurred

Q75: Iris, a calendar year cash basis taxpayer,

Q76: Petal, Inc.is an accrual basis taxpayer.Petal uses

Q77: Which of the following is not a

Q78: Which of the following is correct?

A)A personal

Q81: Austin, a single individual with a salary

Q82: Which of the following is relevant in

Q89: Which of the following statements is correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents