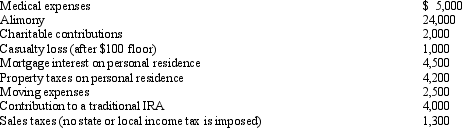

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Which of the following is incorrect?

A) Alimony

Q64: Which of the following cannot be deducted

Q75: Iris, a calendar year cash basis taxpayer,

Q76: Petal, Inc.is an accrual basis taxpayer.Petal uses

Q78: Terry and Jim are both involved in

Q82: Which of the following is relevant in

Q82: Because Scott is three months delinquent on

Q85: Robyn rents her beach house for 60

Q86: Velma and Josh divorced. Velma's attorney fee

Q89: Which of the following statements is correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents