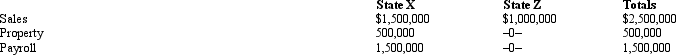

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z.José's activities in both states establish nexus for income tax purposes.José's sales, payroll, and property among the states include the following.  X utilizes an equally weighted three-factor apportionment formula.How much of José's taxable income is apportioned to X?

X utilizes an equally weighted three-factor apportionment formula.How much of José's taxable income is apportioned to X?

A) $79,800.

B) $300,000.

C) $520,200.

D) $600,000.

Correct Answer:

Verified

Q21: A service engineer spends 60% of her

Q31: In most states, Federal S corporations must

Q40: The property factor includes land and buildings

Q41: Helene Corporation owns manufacturing facilities in States

Q44: Perez Corporation is subject to tax only

Q45: Bulky Company sold an asset on the

Q47: In determining a corporation's taxable income for

Q48: José Corporation realized $600,000 taxable income from

Q52: Federal taxable income is used as the

Q60: Under P.L.86-272, which of the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents