Helene Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted.B uses a three-factor apportionment formula under which sales are double-weighted.C employs a single-factor apportionment factor, based solely on sales.

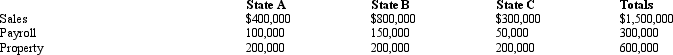

Helene's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows. Helene's apportionable income assigned to A is:

Helene's apportionable income assigned to A is:

A) $0.

B) $266,667.

C) $311,100.

D) $1,000,000.

Correct Answer:

Verified

Q21: A service engineer spends 60% of her

Q30: Typically exempt from the sales/use tax base

Q31: In most states, Federal S corporations must

Q37: Most states' consumer sales taxes apply directly

Q40: The property factor includes land and buildings

Q43: José Corporation realized $600,000 taxable income from

Q44: Perez Corporation is subject to tax only

Q45: Bulky Company sold an asset on the

Q52: Federal taxable income is used as the

Q60: Under P.L.86-272, which of the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents