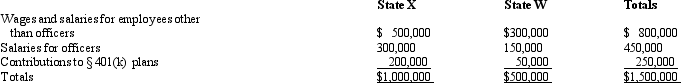

Trayne Corporation's sales office and manufacturing plant are located in State X.Trayne also maintains a manufacturing plant and sales office in State W.For purposes of apportionment, X defines payroll as all compensation paid to employees, including elective contributions to § 401(k) deferred compensation plans.Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor.Trayne incurred the following personnel costs.  Trayne's payroll factor for State X is:

Trayne's payroll factor for State X is:

A) 100.00%.

B) 66.67%.

C) 62.50%.

D) 50.00%.

Correct Answer:

Verified

Q62: General Corporation is taxable in a number

Q64: General Corporation is taxable in a number

Q74: Boot Corporation is subject to income tax

Q77: Bert Corporation, a calendar-year taxpayer, owns property

Q78: The throwback rule requires that:

A)Sales of tangible

Q78: Net Corporation's sales office and manufacturing plant

Q79: A state sales tax usually falls upon:

A)Sales

Q79: General Corporation is taxable in a number

Q83: A taxpayer wishing to reduce the negative

Q87: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents