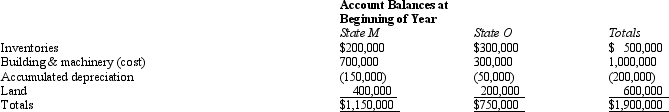

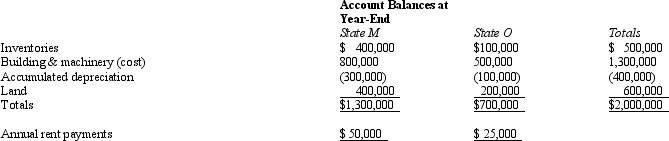

Bert Corporation, a calendar-year taxpayer, owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

Bert's M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Correct Answer:

Verified

Q62: General Corporation is taxable in a number

Q73: Trayne Corporation's sales office and manufacturing plant

Q74: Boot Corporation is subject to income tax

Q78: The throwback rule requires that:

A)Sales of tangible

Q78: Net Corporation's sales office and manufacturing plant

Q79: Valdez Corporation, a calendar-year taxpayer, owns property

Q80: Cruz Corporation owns manufacturing facilities in States

Q83: A taxpayer wishing to reduce the negative

Q93: The starting point in computing state taxable

Q95: _ describe(s) the degree of business activity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents