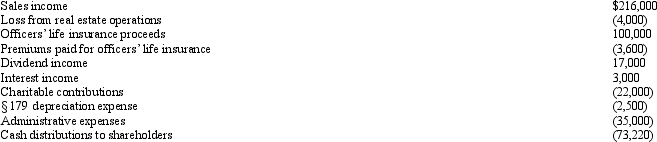

Towne, Inc., a calendar year S corporation, has an AAA amount of $627,050 at the beginning of 2012. During the year, the following items occur.

Calculate Towne's ending AAA balance.

Calculate Towne's ending AAA balance.

Correct Answer:

Verified

Q145: Explain how the domestic production activities deduction

Q149: Trent Huynh is a 45% owner of

Q149: How may an S corporation manage its

Q150: Blue Corporation elects S status effective for

Q151: Individuals Adam and Bonnie form an S

Q151: Milke, Inc., an S corporation, has gross

Q154: Bidden, Inc., a calendar year S corporation,

Q155: Discuss the two methods of allocating tax-related

Q156: On December 31, 2011, Erica Sumners owns

Q157: During 2012, Rasic, the sole shareholder of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents