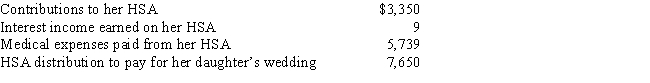

Miki, who is single and 57 years old, has a quaifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a.How much may Miki claim as a deduction for adjusted gross income?

b.What is the amount that Miki must report on her federal income tax return as income from her HSA?

c.How much is subject to a penalty? What is the penalty percentage?

Correct Answer:

Verified

b. $7,650. The distribution f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: If a taxpayer receives an early distribution

Q16: Which of the following statements is true

Q20: In some cases, a taxpayer may deduct

Q41: What is the amount of the deductible

Q43: A 42-year-old single taxpayer earning a salary

Q44: XYZ Corporation has assigned Allison to inspect

Q48: Unreimbursed qualifying moving expenses are an itemized

Q49: Which of the following is not deductible

Q51: Gary and Charlotte incurred the following expenses

Q59: Which of the following statements is false

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents