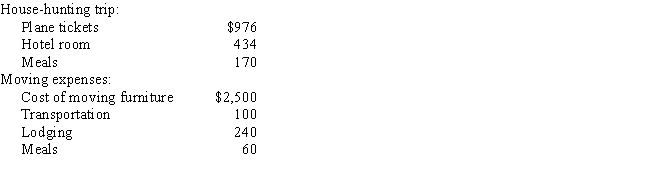

Gary and Charlotte incurred the following expenses in connection with Gary's job transfer from Florida to South Carolina:

How much is their qualified moving expense?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: A taxpayer must make contributions to a

Q14: Subject to the annual dollar limitation and

Q16: Which of the following statements is true

Q17: A taxpayer who is under 50 years

Q17: Since a contribution to an IRA is

Q20: In some cases, a taxpayer may deduct

Q46: Miki, who is single and 57 years

Q48: Unreimbursed qualifying moving expenses are an itemized

Q49: Which of the following is not deductible

Q56: In 2016, all taxpayers may make a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents