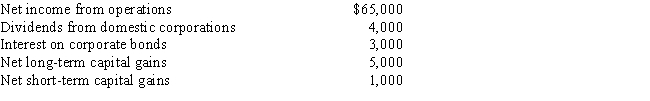

The partnership of Truman and Hanover realized the following items of income during the year ended December 31, 2016: Both the partners are on a calendar year basis. What is the total income which should be reported as ordinary income from business activities of the partnership for 2016?

A) $0

B) $65,000

C) $69,000

D) $71,000

E) None of the above

Correct Answer:

Verified

Q3: Leslie contributes a building worth $88,000, with

Q7: The basis of a partner's interest in

Q9: Which one of the following is not

Q12: An equal partnership is formed by Rita

Q14: Income from a partnership is taxed to

Q24: Please answer the following questions:

a.What form is

Q24: The partnership of Felix and Oscar had

Q25: Cooke and Thatcher form the C&T Partnership.Cooke

Q26: J. Bean and D. Counter formed a

Q36: Partnership losses that are not used because

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents