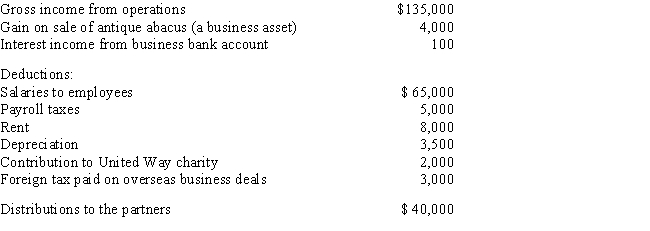

J. Bean and D. Counter formed a partnership. During the current year, the partnership had the following income and expenses:

a.Calculate the net ordinary income.

b.List all of the other items that need to be separately reported.

c.If the partnership is on a calendar year tax basis, when is the partnership tax return due?

Correct Answer:

Verified

Q21: The partnership of Truman and Hanover realized

Q21: A partnership reports its income on Form

Q22: For tax purposes, in computing the ordinary

Q22: Oscar and Frank form an equal partnership,

Q24: The partnership of Felix and Oscar had

Q24: Please answer the following questions:

a.What form is

Q25: Cooke and Thatcher form the C&T Partnership.Cooke

Q28: Jennifer has a 25 percent interest in

Q35: Which of the following items must be

Q36: Partnership losses that are not used because

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents