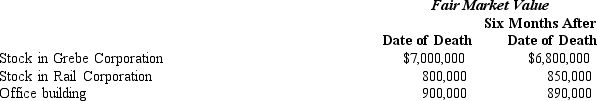

Among the assets included in Taylor's gross estate are the following.

Three months after Taylor's death in 2013, her executor sells the Rail stock for $830,000.

a. What is the amount of Taylor's gross estate if date of death value is used?

b. What is the amount of Taylor's gross estate if the alternate valuation date is elected?

c. Suppose all of Taylor's assets pass to her surviving spouse. Does this have any impact on the choice of valuation date? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: At the time of his death on

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q125: Murray owns an insurance policy on the

Q126: In 1992, Daniel and Mia acquire realty

Q127: In 1985, Drew creates a trust with

Q132: Jacob and Emma are husband and wife

Q133: Prior to his death in 2012, Ethan

Q135: In 2005, Noah and Kelly acquire real

Q139: At the time of her death, Chloe

Q143: At the time of Clint's death, part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents