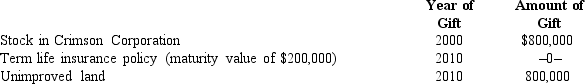

Prior to his death in 2012, Ethan made the following taxable gifts.

The policy on Ethan's life was given to the designated beneficiary. The gift of the stock and the land generated gift taxes of $28,750 and $65,250, respectively.

The policy on Ethan's life was given to the designated beneficiary. The gift of the stock and the land generated gift taxes of $28,750 and $65,250, respectively.

As to these transfers, how much is included in Ethan's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: At the time of his death on

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q130: Among the assets included in Taylor's gross

Q132: Jacob and Emma are husband and wife

Q135: In 2005, Noah and Kelly acquire real

Q136: Ben and Lynn are married and have

Q136: At the time of her death,Audrey was

Q137: June made taxable gifts as follows: $200,000

Q139: At the time of her death, Chloe

Q143: At the time of Clint's death, part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents