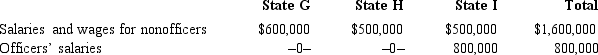

Garcia Corporation is subject to tax in States G, H, and I. Garcia's compensation expense includes the following.

Officers' salaries are included in the payroll factor for States G and H, but not for I. Compute Garcia's payroll

factors for G, H, and I.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Kim Corporation, a calendar year taxpayer, has

Q128: Compute Still Corporation's State Q taxable income

Q132: Hill Corporation is subject to tax only

Q134: A state might levy a(n) tax when

Q134: Dott Corporation generated $300,000 of state taxable

Q135: The sale of groceries to an individual

Q135: Condor Corporation generated $450,000 of state taxable

Q136: The tax levied by a state usually

Q136: Mercy Corporation, headquartered in State F, sells

Q140: A _ tax is designed to complement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents