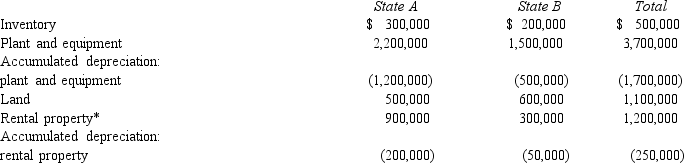

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim's

property holdings follows.

Beginning of Year

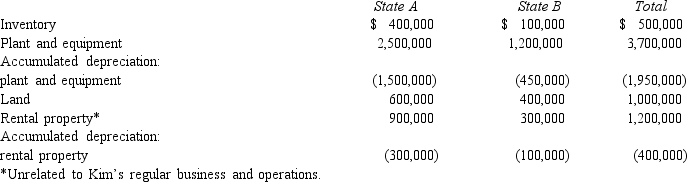

End of Year

End of Year

Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Determine Kim's property factors for the two states. A's statutes provide that the average historical cost of business property is to be included in the property factor. B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: You are completing the State A income

Q122: If a gift card is unused after

Q122: Flip Corporation operates in two states, as

Q124: Provide the required information for Orange Corporation,

Q128: Compute Still Corporation's State Q taxable income

Q131: Garcia Corporation is subject to tax in

Q134: A state might levy a(n) tax when

Q135: The sale of groceries to an individual

Q140: A _ tax is designed to complement

Q160: An ad valorem property tax is based

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents